- Guaranteed accurate federal, state and local tax calculations

- Direct deposit

- Professional paychecks and pay stubs

- Secure online employee access to pay stubs

- Wage garnishments

- Vacation and sick pay tracking

- Pay types: salary, hourly wages, multiple

pay rates, bonuses, cash tips, paycheck

tips, expense reimbursements, allowances,

holiday, and more - Voluntary deductions: taxable and pre-tax

premiums for medical, dental, and vision;

retirement plans; flexible spending accounts:

dependent and medical care; cash advance

and loan repayments; and others

USA Payroll Network

Providing Cost Effective Payroll Solutions since 2010.Payroll Services Small Business

Focus more on your business and let us handle all of your payroll hassles.

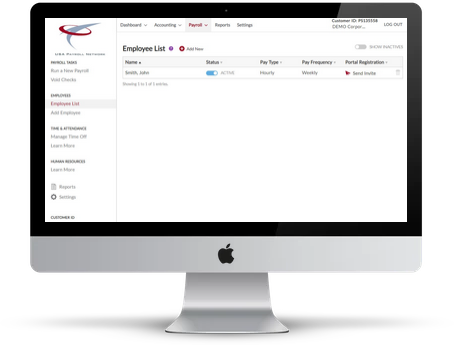

Employees

Keep track of all employee information, all in one place.

- Employee Pay Rate

- Employee Payment Method

- Employee List

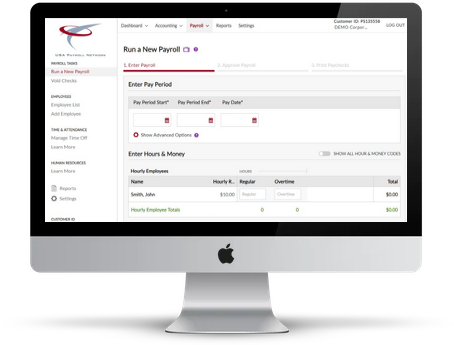

Payday

Track all of your employees and contractors hours in one place.

- Salary and Hourly Employee Tracking

- Sick and Vacation Pay

- Payment Details

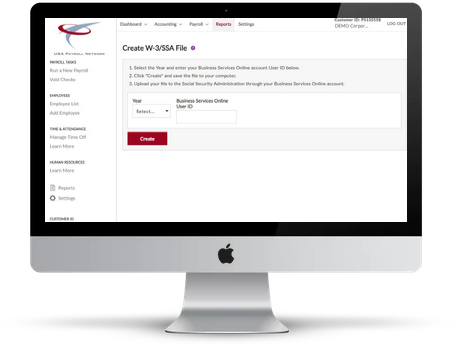

Taxes & Forms

Leave all of your tax headaches to us, file and pay through us.

- File Taxes

- Pay Taxes

- Employee and Contractor reports

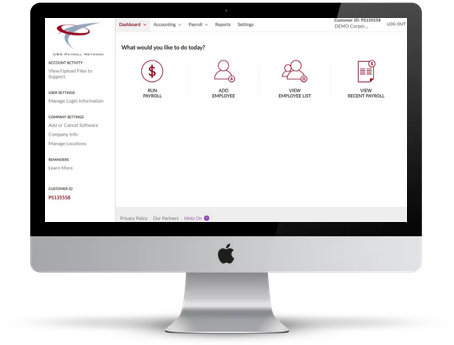

To Do List

Setup and maintain all of your business back end solutions with our software.

- Tax Due Dates

- Employee Setup

- Time Sheet Setup

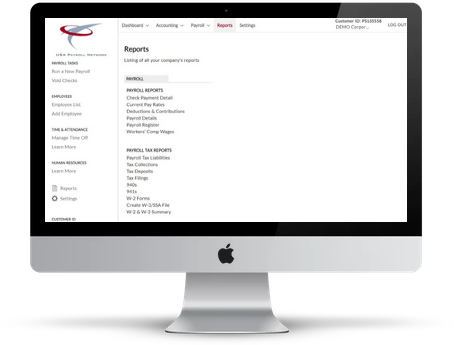

Reports

All of your reports under one roof, view your companies reports at a glance.

- Payroll Reports

- Tax Reports

- Compensation Reports

Features

Key features from our payroll solutions package.

Accurate Paydays

Federal Tax Deposits and Filings

- Quarterly and year-end filings

- W-2’s

- W-4’s, I-9’s and employer registration forms

State Tax Deposits and Filings

- Quarterly and year-end filings

- Multi-state tax payments and filings

- New hire reporting

- Employer registration forms

Accounting Software Integration

- Payroll data integration available for

QuickBooks Desktop® and QuickBooks Online®

Detailed, Insightful Reports

- Payroll Reports: Check Payment Detail, Current Pay Rates, Deductions & Contributions, Direct Deposit Details, Payroll Details, Payroll Register and Worker’s Comp Wages

- Payroll Tax Reports: Payroll Tax Liabilities, Tax Collections, Tax Deposits, Tax Filings, 941’s W2 Forms W-2 & W-3 Summary

Frequently Asked Questions

Frequently asked questions from our clients.

What do I need to get started?

All we need is your company and employee information, and payroll

history (if any) for this year. Call us to schedule an appointment to

discuss your payroll requirements.

Can I switch payroll providers mid-year?

Yes, we can start your payroll any time as long as you have records

of your payroll history.

What about W-2’s?

At year-end, we create W-2 forms for you and your employees. And

we take care of filing them with the Social Security Administration.

Do employees get online access to their pay stubs?

Absolutely. Your employees can also access their pay stubs securely

online at PaycheckRecords.com, 24 hours a day, 7 days a week.

Can I import payroll information to my accounting software?

Yes, we can help you import payroll data into accounting software

such as QuickBooks®, QuickBooks Online Edition, QuickBooks for

Mac, Peachtree®, ATX Client Write-UpTM, TaxWise Client Write-UpTM,

CCH ProSystem fx® Write-Up, and Microsoft® Money, so that all information

is in one place.

How will I stay on top of my payroll details?

We will provide you with a variety of reports that will allow you to

remain informed and in control of your payroll.

Do you still have questions?

Contact

If you are interested in a new payroll solution for your company, fill out the form below or call us at 800-652-4904